Kicking off with long-term care insurance, this overview dives into what it covers, who needs it, and more. Get ready to explore the ins and outs of this crucial insurance option.

What is Long-Term Care Insurance?

Long-term care insurance is a type of coverage that helps individuals pay for services and support when they are unable to care for themselves due to age, disability, or chronic illness.

Coverage of Long-Term Care Insurance

Long-term care insurance typically covers:

- Nursing home care

- Assisted living facilities

- In-home care services

- Adult day care

- Alzheimer’s care

Benefits of Long-Term Care Insurance

Having long-term care insurance provides the following benefits:

- Financial protection against high long-term care costs

- Ability to choose care options and locations

- Preservation of assets and savings for loved ones

- Peace of mind knowing that care needs will be met

Who Typically Needs Long-Term Care Insurance

Individuals who may benefit from long-term care insurance include:

- Seniors who want to maintain independence as they age

- Individuals with chronic conditions or disabilities

- Adults who do not have family caregivers available

- Individuals who want to protect their assets and savings

Types of Long-Term Care Insurance Policies

When it comes to long-term care insurance, there are different types of policies available to meet varying needs and preferences. These policies can be broadly categorized into traditional long-term care insurance and hybrid long-term care insurance.

Traditional Long-Term Care Insurance

Traditional long-term care insurance policies are standalone policies specifically designed to cover long-term care expenses. These policies provide coverage for services such as nursing home care, assisted living facilities, and in-home care. Here are some key features of traditional long-term care insurance policies:

- Benefits: Traditional policies offer a daily benefit amount that can be used to cover long-term care services.

- Coverage Limits: These policies have specific coverage limits, such as a maximum benefit period or a maximum benefit amount.

- Eligibility: To receive benefits, the insured must meet the policy’s eligibility criteria, such as the inability to perform certain activities of daily living.

- Inflation Protection: Some traditional policies offer inflation protection riders to help keep pace with the rising costs of long-term care services.

Hybrid Long-Term Care Insurance

Hybrid long-term care insurance policies combine long-term care coverage with life insurance or annuities. These policies offer a death benefit if long-term care is not needed, providing a way to recoup premiums paid. Here are some key features of hybrid long-term care insurance policies:

- Benefits: Hybrid policies provide coverage for both long-term care expenses and a death benefit for beneficiaries.

- Coverage Limits: These policies typically have more flexibility in terms of benefit amounts and payout options compared to traditional policies.

- Eligibility: The eligibility criteria for hybrid policies may differ from traditional policies, so it’s important to review the specific terms and conditions.

- Inflation Protection: Some hybrid policies include inflation protection features to help protect against the rising costs of long-term care services.

Cost Factors and Affordability

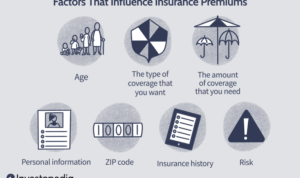

When considering long-term care insurance, it’s important to understand the factors that can influence the cost and explore strategies to make it more affordable.

Factors Influencing Cost

- Age: Younger individuals typically pay lower premiums compared to older individuals.

- Health Status: Pre-existing health conditions may increase the cost of insurance.

- Coverage Amount: Higher coverage limits result in higher premiums.

- Benefit Period: Longer benefit periods lead to higher costs.

- Insurance Company: Different providers offer varying rates for similar coverage.

Strategies for Affordability

- Start Early: Purchasing insurance at a younger age can result in lower premiums.

- Choose a Shared Policy: Couples can save money by purchasing a joint long-term care insurance policy.

- Opt for Limited Coverage: Consider policies with shorter benefit periods or lower daily benefit amounts to reduce costs.

- Look for Discounts: Some insurers offer discounts for healthy lifestyle choices or group memberships.

Choosing a Cost-Effective Policy

- Compare Quotes: Obtain quotes from multiple insurance companies to find the most competitive rates.

- Consider Inflation Protection: While it may increase initial costs, inflation protection can help ensure coverage keeps pace with rising care costs.

- Review Policy Features: Ensure the policy covers services you are likely to need and exclude unnecessary add-ons to keep costs down.

- Consult with an Expert: Speak with a financial advisor or insurance agent to navigate the complexities of long-term care insurance and find the best value for your budget.

Eligibility and Coverage: Long-term Care Insurance

To be eligible for long-term care insurance, individuals typically need to meet certain criteria such as being in good health at the time of application, not currently needing long-term care services, and being within a certain age range, usually between 18 to 84 years old. Pre-existing conditions may affect eligibility and coverage options.

Types of Care Covered, Long-term care insurance

- Nursing home care

- Assisted living facility care

- Home health care

- Hospice care

- Adult day care

Scenarios for Utilizing Coverage

Example 1:

An individual who experiences a fall and requires rehabilitation services at a nursing home can utilize their long-term care insurance to cover the costs of their stay and therapy sessions.

Example 2:

A person diagnosed with a chronic illness that requires ongoing assistance with daily activities may use their long-term care insurance to pay for a caregiver to come to their home and provide support.

Example 3:

An elderly individual who wants to maintain their independence but needs help with medication management can access their long-term care insurance to cover the expenses of a medication reminder service.

Alternatives to Long-Term Care Insurance

When it comes to financing long-term care expenses, there are several alternatives to long-term care insurance that individuals can consider. These alternatives vary in terms of cost, coverage, and eligibility requirements.

Self-Funding

Self-funding is one alternative to long-term care insurance where individuals use their own savings and assets to cover long-term care expenses. This approach may be suitable for those who have significant financial resources and are able to set aside funds specifically for future care needs.

Government Programs

Government programs such as Medicaid and Veterans Affairs benefits offer assistance with long-term care costs for eligible individuals. These programs have specific eligibility criteria based on income, assets, and care needs. While they can provide financial support, the coverage and services may be limited compared to long-term care insurance.

Pros and Cons

- Self-Funding: Pros include flexibility in choosing care options and no premium payments. However, the potential risk of depleting savings and uncertainty of future care needs are significant cons.

- Government Programs: Pros include financial assistance for those who qualify and coverage for certain services. Cons may include limited options for care providers and services, as well as strict eligibility requirements.