Life insurance plans set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset. From different plan types to the importance of having life insurance and factors to consider when choosing a plan, this topic dives deep into the world of financial security and protection.

Get ready to explore the ins and outs of life insurance plans in a way that’s informative, engaging, and totally rad.

Types of Life Insurance Plans

Life insurance plans come in various types to cater to different needs and preferences. The most common types include term life insurance, whole life insurance, and universal life insurance.

Term Life Insurance vs. Whole Life Insurance

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years, and pays out a death benefit if the insured passes away during the term. It is typically more affordable than whole life insurance and does not build cash value. On the other hand, whole life insurance covers the insured for their entire life and includes a cash value component that grows over time. It tends to have higher premiums but offers lifelong protection and an investment feature.

Universal Life Insurance Features and Benefits

Universal life insurance is a flexible policy that combines a death benefit with a savings component. It allows policyholders to adjust their premiums and death benefits as their needs change. The cash value in a universal life insurance policy earns interest based on current market rates, providing potential growth over time. This type of insurance offers more flexibility and control compared to traditional whole life insurance, making it a popular choice for those looking for a customizable policy.

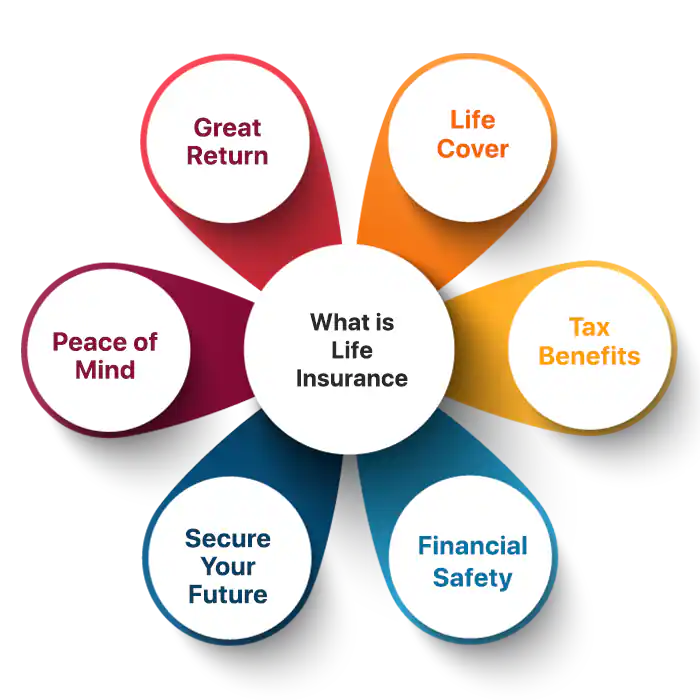

Importance of Life Insurance

Life insurance is a crucial component of financial planning that provides a safety net for your loved ones in the event of your untimely death. It offers peace of mind knowing that your family will be financially protected and taken care of even when you are no longer there to provide for them.

Financial Security

Life insurance ensures that your family’s financial future is secure, especially if you are the primary breadwinner. It can cover expenses such as mortgage payments, education costs, daily living expenses, and even final expenses like funeral costs. Without life insurance, your loved ones may struggle to make ends meet and maintain their standard of living.

Debt Protection, Life insurance plans

In the unfortunate event of your passing, life insurance can help pay off any outstanding debts you may leave behind, such as credit card debt, loans, or medical bills. This prevents your family from being burdened with financial obligations that they may not be able to afford on their own.

Income Replacement

Life insurance can replace your income and provide for your family’s ongoing needs. This is especially important if you have young children, a spouse who does not work, or other dependents who rely on your income. It ensures that your loved ones can maintain their lifestyle and financial stability even after you are gone.

Legacy Planning

Life insurance can also be used as a tool for legacy planning, allowing you to leave a financial inheritance for your loved ones or contribute to charitable causes that are important to you. It helps you create a lasting impact beyond your lifetime and ensures that your financial assets are distributed according to your wishes.

Factors to Consider When Choosing a Life Insurance Plan

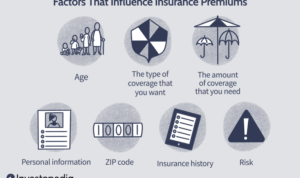

When selecting a life insurance plan, there are several factors that individuals should consider to ensure they are adequately protected. Factors such as age, health status, and coverage amount play a crucial role in determining the right life insurance policy.

Impact of Age and Health Status on Life Insurance Premiums

Age and health status are two significant factors that can impact life insurance premiums. Younger individuals and those in good health typically pay lower premiums compared to older individuals or those with pre-existing medical conditions. Insurance companies assess the risk of insuring an individual based on these factors, which ultimately affects the cost of the policy.

Determining the Right Coverage Amount

When determining the right coverage amount for a life insurance policy, it’s essential to consider factors such as financial obligations, future expenses, and long-term financial goals. Calculating the coverage amount involves evaluating current debts, anticipated future expenses (such as education costs or mortgages), and the financial needs of dependents. It’s important to strike a balance between providing adequate coverage for loved ones and ensuring the premiums are affordable.

How Life Insurance Works: Life Insurance Plans

Life insurance works by providing financial protection to the policyholder’s beneficiaries in the event of the policyholder’s death.

Premiums, Coverage, and Beneficiaries

Life insurance policies require the policyholder to pay regular premiums to the insurance company. In return, the insurance company promises to pay a lump sum, known as the death benefit, to the designated beneficiaries upon the policyholder’s passing. The coverage amount and premium rates are determined based on factors such as the policyholder’s age, health, and desired coverage amount.

- Beneficiaries: The beneficiaries are the individuals or entities chosen by the policyholder to receive the death benefit. They can be family members, friends, or even charitable organizations.

- Receiving the Death Benefit: When the policyholder passes away, the beneficiaries need to file a claim with the insurance company to receive the death benefit. Once the claim is approved, the beneficiaries will receive the lump sum payment.

- Expenses Coverage: Life insurance payouts can help cover various expenses after the policyholder’s passing, such as funeral costs, outstanding debts, mortgage payments, and living expenses. This financial support can provide peace of mind to the beneficiaries during a difficult time.