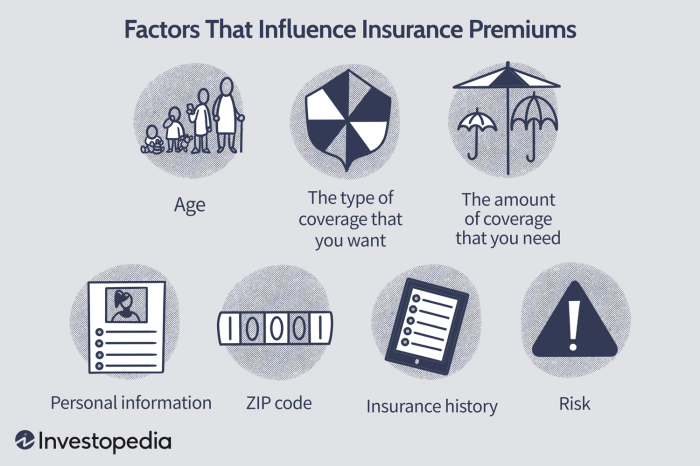

Get ready to dive into the world of insurance premium calculation, where factors like age, location, and technology play a crucial role in determining your costs. This topic will break down the complexities of how your premium is calculated, giving you a peek behind the curtain of the insurance industry.

Factors affecting insurance premium calculation

When it comes to calculating insurance premiums, several factors come into play that can influence the final cost. These factors include age, gender, location, driving record, and the type of coverage being selected.

Age

Age is a significant factor in determining insurance premiums. Younger drivers are typically charged higher premiums due to their lack of driving experience and higher likelihood of being involved in accidents. As drivers get older and gain more experience, their premiums tend to decrease.

Gender

Gender can also impact insurance premiums, with statistics showing that male drivers are more likely to be involved in accidents compared to female drivers. As a result, males often face higher insurance premiums than their female counterparts.

Location

Where you live plays a crucial role in determining your insurance premium. Urban areas with higher population densities and increased traffic congestion usually have higher premiums due to the greater risk of accidents and theft. On the other hand, rural areas with fewer incidents may have lower premiums.

Driving Record

A driver’s past driving record is a key factor in premium calculation. Those with a history of accidents or traffic violations are considered high-risk drivers and may face higher premiums. Conversely, drivers with a clean record are rewarded with lower premiums.

Type of Coverage

The type of coverage selected also affects premium costs. Comprehensive coverage, which provides more extensive protection, typically comes with higher premiums compared to basic liability coverage. Drivers can choose the level of coverage based on their needs and budget.

Methods used in insurance premium calculation

Insurance companies use various methods to calculate premiums, each with its own advantages and limitations. The three main methods include the actuarial method, judgment rating, and class rating.

Actuarial Method

The actuarial method involves using statistical data and mathematical models to predict the likelihood of an event occurring and the potential costs associated with it. Actuaries analyze historical data, such as claims and demographic information, to estimate the risk of insuring a particular individual or group. By taking into account various factors, actuaries can calculate a fair and accurate premium that reflects the level of risk involved.

Judgment Rating

Judgment rating relies on the expertise and experience of underwriters to assess the risk of insuring a policyholder. Underwriters use their judgment to determine the premium based on factors such as the individual’s occupation, lifestyle, and health history. While this method allows for flexibility and customization, it may introduce subjectivity and bias into the pricing process.

Class Rating

Class rating involves categorizing policyholders into groups based on similar characteristics, such as age, gender, and location. Each group is assigned a specific premium rate, regardless of individual differences within the group. This method simplifies the pricing process and allows for faster calculations, but it may not accurately reflect the true risk profile of each policyholder.

In practice, insurance companies often use a combination of these methods to calculate premiums. Actuarial methods are typically favored for complex risks, while judgment rating and class rating are more commonly used for simpler policies. The choice of method depends on the type of insurance coverage, industry standards, and regulatory requirements.

Technology advancements in insurance premium calculation

Technology advancements, such as big data analytics and AI algorithms, are revolutionizing the insurance industry’s premium calculation process. These cutting-edge technologies have transformed the way insurance companies assess risk and determine the premiums for their policyholders.

Using big data analytics, insurance companies can now analyze vast amounts of data to identify patterns and trends that were previously impossible to detect. This allows insurers to make more accurate predictions about the likelihood of claims and adjust premiums accordingly. AI algorithms, on the other hand, can automate the premium calculation process, saving time and reducing human error.

The benefits of using technology in premium calculation are numerous. Firstly, it increases efficiency by streamlining the process and reducing the time it takes to calculate premiums. Secondly, it improves accuracy by eliminating human error and providing more precise risk assessments. Lastly, technology allows for personalized pricing, where premiums are tailored to individual policyholders based on their specific risk profile.

Insurance companies leveraging advanced technology

- Lemonade: Lemonade is an insurance company that utilizes AI algorithms to automate the underwriting process and calculate premiums quickly and accurately.

- Metromile: Metromile uses telematics technology to track customers’ driving behavior and calculate premiums based on actual usage, offering more personalized pricing for auto insurance.

- Oscar Health: Oscar Health employs big data analytics to analyze healthcare claims data and predict future healthcare costs, allowing them to set competitive premiums for their health insurance plans.

Regulation and compliance in insurance premium calculation

Insurance premium calculation is governed by a strict regulatory framework that includes laws, guidelines, and industry standards to ensure fair and transparent practices. Compliance with these regulations is crucial for insurance companies to maintain trust and credibility with their customers.

Importance of Regulatory Compliance, Insurance premium calculation

- Regulations help in standardizing premium calculation methods across the industry, ensuring consistency and fairness.

- Compliance with laws and guidelines protects consumers from unfair practices and helps in maintaining a level playing field for all insurance providers.

- Transparency in premium calculation builds trust with policyholders and promotes a positive reputation for insurance companies.

Consequences of Non-Compliance

- Non-compliance with regulatory requirements can result in penalties imposed by regulatory authorities, leading to financial losses for insurance companies.

- Legal issues may arise if insurance companies fail to adhere to the prescribed regulations, potentially resulting in lawsuits and damage to their reputation.

- Non-compliance can also lead to loss of customer trust and loyalty, impacting the long-term sustainability of the insurance business.