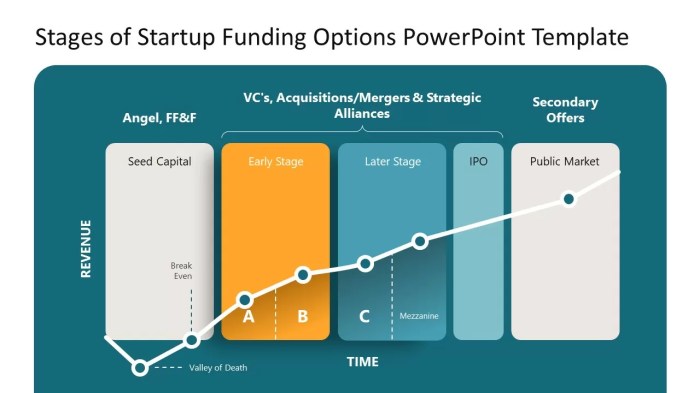

Startup funding options open the door to a world of financial possibilities, where bootstrapping, angel investors, venture capital, crowdfunding, and loans are the keys to unlocking your entrepreneurial dreams. Get ready for a journey filled with twists, turns, and lucrative insights as we dive into the realm of startup funding options.

From the diverse landscape of funding sources to the challenges and triumphs of each option, this guide will equip you with the knowledge needed to navigate the competitive world of startup financing.

Types of Startup Funding Options

Starting a new business requires funding, and there are various options available for entrepreneurs to consider. Let’s take a look at the different types of startup funding options and their pros and cons.

Bootstrapping

Bootstrapping is when a business funds itself without relying on external sources. This can involve using personal savings, revenue from early sales, or even credit cards.

- Advantages:

Allows for full control over the business and avoids debt or equity dilution.

- Disadvantages:

Limited capital available, which can constrain growth opportunities.

Angel Investors

Angel investors are individuals who provide capital to startups in exchange for ownership equity or convertible debt.

- Advantages:

Can provide valuable expertise and connections in addition to funding.

- Disadvantages:

May require giving up a portion of ownership and decision-making control.

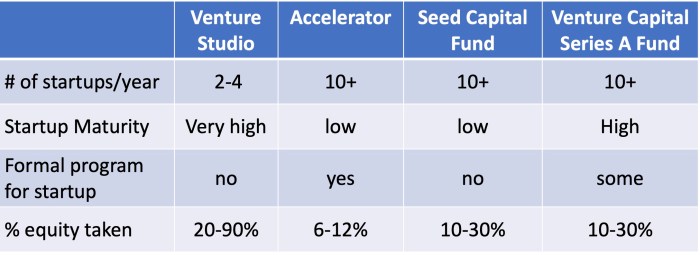

Venture Capital

Venture capital firms invest in high-growth startups in exchange for equity. They typically look for businesses with high growth potential.

- Advantages:

Can provide significant capital for rapid growth and expansion.

- Disadvantages:

Requires giving up a substantial portion of ownership and may come with pressure to achieve aggressive growth targets.

Crowdfunding

Crowdfunding involves raising small amounts of money from a large number of people, typically through online platforms.

- Advantages:

Allows for validation of product or idea by the market and can create a community of supporters.

- Disadvantages:

May require a significant amount of time and effort to run a successful campaign.

Loans

Obtaining a loan from a financial institution is another common way to fund a startup. This can include traditional bank loans, lines of credit, or Small Business Administration (SBA) loans.

- Advantages:

Provides access to capital with predictable repayment terms.

- Disadvantages:

Requires repayment with interest, which can add financial pressure to the business.

Bootstrapping

Bootstrapping is a funding option for startups where the founders use their own resources to fund the business instead of seeking external investors or loans. This could involve personal savings, credit card debt, or revenue generated from the business itself.

Successful Companies that Bootstrapped

- Basecamp: This project management software company was started by Jason Fried and David Heinemeier Hansson with just $10,000 of their own money.

- Mailchimp: The popular email marketing platform was founded by Ben Chestnut and Dan Kurzius without any external funding.

- Spanx: Sara Blakely started this successful shapewear company with her own savings of $5,000.

Challenges of Bootstrapping, Startup funding options

- Slow growth: Without external funding, startups may struggle to scale quickly and keep up with competitors.

- Limited resources: Bootstrapped companies may face constraints when it comes to hiring talent, marketing, or expanding operations.

- Risk: Founders bear all the financial risk themselves, which can be daunting and stressful.

Angel Investors

Angel investors play a crucial role in providing capital to early-stage startups in exchange for ownership equity in the company. These individuals are typically high-net-worth individuals who invest their own money in promising startups with the potential for high returns.

Finding and Pitching to Angel Investors

Finding angel investors can be done through networking events, startup accelerators, online platforms, or through personal connections. It is important to do thorough research on potential investors to ensure they align with your startup’s vision and goals. When pitching to angel investors, focus on highlighting the unique value proposition of your startup, your target market, traction achieved so far, and the potential for growth and scalability. It is also important to be prepared to answer tough questions and demonstrate a solid business plan.

Success Stories

– Uber: Uber was initially funded by angel investors like Chris Sacca and Jason Calacanis, who saw the potential of the ride-sharing app and invested early on. This early funding helped Uber grow rapidly and become the global giant it is today.

– Airbnb: Airbnb received funding from angel investor Reid Hoffman, who recognized the disruptive potential of the home-sharing platform. This investment played a significant role in Airbnb’s journey to becoming a household name in the travel industry.

Venture Capital

Venture capital is a type of funding provided by investors to startup companies and small businesses that have the potential for long-term growth. This form of funding is crucial for startups looking to scale their operations and reach a wider market. Venture capitalists typically take equity in the company in exchange for their investment, and they play an active role in guiding the company towards success.

Securing Venture Capital

Securing venture capital involves a rigorous process that starts with identifying potential investors who specialize in the industry or sector of the startup. Entrepreneurs need to prepare a solid business plan and pitch deck to showcase their vision, market opportunity, and growth potential. Once a meeting is secured with a venture capitalist, entrepreneurs must be prepared to answer tough questions and demonstrate their ability to execute the business plan effectively.

Criteria for Venture Capital Investments

- Market Potential: Venture capitalists look for startups operating in large and rapidly growing markets with the potential to disrupt existing industries.

- Strong Team: VCs assess the founding team’s experience, expertise, and passion for the business to ensure they can successfully execute the business plan.

- Scalability: VCs seek startups with a scalable business model that can grow quickly and capture a significant market share.

- Exit Strategy: Investors want to know how they will realize a return on their investment, so having a clear exit strategy, such as acquisition or IPO, is crucial.

- Competitive Advantage: VCs evaluate the startup’s competitive positioning and unique value proposition to determine its ability to outperform competitors.

Crowdfunding

Crowdfunding is a way for startups to raise funds by collecting small amounts of money from a large number of people, typically online. It allows entrepreneurs to pitch their business ideas to a broad audience and receive financial support in return.

Popular Crowdfunding Platforms and Benefits

- Kickstarter: One of the most well-known crowdfunding platforms, Kickstarter allows startups to showcase their projects and receive funding from backers. Benefits include a large community of potential supporters and the ability to offer rewards to backers.

- Indiegogo: Another popular platform, Indiegogo offers flexible funding options where startups can keep the funds raised even if the campaign does not reach its goal. Benefits include a global reach and access to Indiegogo’s marketing tools.

- GoFundMe: While traditionally used for personal causes, GoFundMe has become a popular choice for startups looking to raise funds. Benefits include a simple setup process and the ability to share the campaign easily on social media.

Tips for Running a Successful Crowdfunding Campaign

- Set a realistic funding goal: Make sure to calculate how much money you need for your startup and set a goal that is achievable.

- Create a compelling campaign page: Use engaging visuals, videos, and a clear description of your startup to attract backers.

- Promote your campaign: Spread the word about your crowdfunding campaign through social media, email newsletters, and other marketing channels.

- Offer attractive rewards: Provide backers with incentives to support your startup, such as early access to products, exclusive merchandise, or personalized experiences.

- Engage with your backers: Keep your supporters updated on the progress of your campaign and show appreciation for their contributions.

Loans

Starting a business can be an exciting venture, but securing funding is often a major challenge for many startups. One common option for funding is taking out a loan. Here, we will explore different types of loans available for startups, discuss the pros and cons of taking out loans, and provide guidance on how to approach and secure a business loan.

Types of Loans

- Traditional Bank Loans: These are loans provided by banks or financial institutions that require collateral and have fixed repayment terms.

- SBA Loans: Small Business Administration (SBA) loans are backed by the government and offer competitive rates and terms for small businesses.

- Microloans: Microloans are small loans typically offered by non-profit organizations or online lenders to help startups with limited funding needs.

- Equipment Loans: These loans are specifically for purchasing equipment needed for the business, with the equipment itself serving as collateral.

Pros and Cons of Taking Out Loans

- Pros:

- Access to Capital: Loans provide immediate funding to cover startup costs and business expenses.

- Build Credit: Timely repayments on a loan can help establish and improve the business’s credit history.

- Cons:

- Debt: Taking out a loan means adding debt to the business, which must be repaid with interest.

- Risk: If the business fails, the loan still needs to be repaid, putting the business owner’s personal assets at risk.

Securing a Business Loan

When approaching a lender for a business loan, it’s important to have a solid business plan that Artikels the purpose of the loan, how it will be used, and a repayment strategy. Here are some steps to help secure a business loan:

- Research Lenders: Look for lenders that specialize in providing loans to startups or small businesses.

- Prepare Documentation: Gather necessary documents such as financial statements, business plan, and personal credit history.

- Meet Requirements: Ensure that the business meets the lender’s eligibility criteria and requirements.

- Negotiate Terms: Review and negotiate the terms of the loan, including interest rates, repayment schedule, and collateral.