Liability insurance guide sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

Navigating the complex world of liability insurance can be daunting, but with this comprehensive guide, you’ll be equipped with all the knowledge you need to make informed decisions and protect yourself or your business effectively.

Overview of Liability Insurance

Liability insurance is a crucial type of coverage that protects individuals and businesses from financial loss resulting from legal claims or lawsuits. It provides coverage for damages and legal defense costs in the event that the policyholder is found liable for causing harm to another person or property.

Types of Liability Insurance

- General Liability Insurance: This type of insurance provides coverage for bodily injury, property damage, and personal injury claims that occur on the policyholder’s premises or as a result of their operations.

- Professional Liability Insurance: Also known as errors and omissions insurance, this coverage is designed to protect professionals from claims of negligence or inadequate work performance that result in financial loss for their clients.

- Product Liability Insurance: This insurance is essential for businesses that manufacture, distribute, or sell products. It provides coverage for claims related to product defects that cause injury or property damage.

Key Features of Liability Insurance Policies

Liability insurance policies vary based on the coverage needs of the policyholder. Some key features to consider include:

- Coverage Limits: The maximum amount the insurance company will pay for a covered claim.

- Deductibles: The amount the policyholder must pay out of pocket before the insurance coverage kicks in.

- Exclusions: Specific situations or types of claims that are not covered by the insurance policy.

- Legal Defense Costs: Coverage for legal expenses, including attorney fees and court costs, in the event of a lawsuit.

Benefits of Liability Insurance: Liability Insurance Guide

Having liability insurance brings a range of advantages that can protect individuals and businesses from financial risks and legal challenges. This type of coverage provides a safety net in case of unforeseen circumstances or accidents, offering peace of mind and security.

Financial Protection

- Liability insurance can cover the costs of legal defense, settlements, or judgments in case someone files a lawsuit against you or your business.

- It helps prevent financial losses by providing coverage for damages or injuries caused to others, such as property damage or bodily harm.

Legal Coverage

- With liability insurance, you have access to legal experts who can guide you through the legal process and represent your interests in court.

- It can help cover legal fees and court costs, saving you from the burden of expensive litigation expenses.

Enhanced Reputation

- Having liability insurance can enhance your reputation and credibility, showing clients and partners that you are a responsible and reliable individual or business.

- It demonstrates a commitment to protecting others and taking responsibility for your actions, which can build trust and confidence in your relationships.

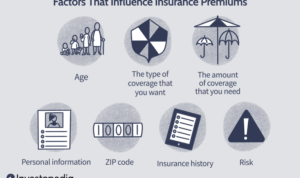

Factors to Consider When Choosing Liability Insurance

When choosing a liability insurance policy, there are several key factors that individuals or businesses should take into consideration to ensure they get the right coverage for their needs. It’s important to compare different coverage options, deductibles, premiums, and limits to determine the most suitable policy. Additionally, industry-specific risks can play a significant role in influencing the choice of liability insurance coverage.

Types of Coverage Options

- General Liability: Provides coverage for bodily injury, property damage, and personal injury claims.

- Professional Liability: Also known as errors and omissions insurance, this type of coverage protects against claims of negligence or inadequate work.

- Product Liability: Covers legal costs in case a product causes harm or injury to a consumer.

Comparison of Deductibles and Premiums

- Higher deductibles usually result in lower premiums, but it’s essential to choose a deductible that you can afford to pay out of pocket in case of a claim.

- Premiums can vary based on factors such as the level of coverage, industry risks, and the size of the business.

- Consider getting quotes from multiple insurance providers to compare costs and coverage options.

Policy Limits and Exclusions

- Policy limits determine the maximum amount the insurance company will pay for a covered claim.

- Be aware of any exclusions in the policy that may limit coverage for specific risks or circumstances.

- Examine the fine print of the policy to understand what is and isn’t covered to avoid surprises during a claim.

How to File a Liability Insurance Claim

When it comes to filing a liability insurance claim, understanding the process and being prepared can make all the difference in ensuring a smooth experience. Here’s a breakdown of what you need to know:

Documentation Required, Liability insurance guide

- First and foremost, make sure to gather all relevant documentation related to the incident that led to the claim. This may include photos, witness statements, police reports, and any other evidence supporting your case.

- Provide any communication or correspondence with the other party involved, as well as any medical records or bills if the claim involves bodily injury.

- Fill out the claim form provided by your insurance company accurately and completely, ensuring all details are correct to avoid delays in processing.

Steps Involved

- Contact your insurance company as soon as possible to report the incident and initiate the claim process. Be prepared to provide all necessary information and documentation to support your claim.

- Your insurance company will assign a claims adjuster to investigate the incident and assess the damages. Cooperate fully with the adjuster and provide any additional information they may request.

- Once the investigation is complete, your insurance company will determine the coverage and amount of compensation you are entitled to receive. They will then provide you with a settlement offer or explanation of their decision.

Tips for a Smooth Claims Process

- Keep detailed records of all interactions with your insurance company, including phone calls, emails, and letters exchanged. This can help you track the progress of your claim and ensure nothing falls through the cracks.

- Be proactive in following up with your insurance company if you have not heard back within a reasonable timeframe. Prompt communication can help expedite the claims process.

- Seek guidance from a legal professional if you encounter any challenges or disputes during the claims process. They can provide valuable advice and support to help protect your rights.

Common Challenges to Avoid

- Avoid delaying the reporting of the incident to your insurance company, as this can lead to complications or even denial of your claim.

- Do not exaggerate or falsify information when filing a claim, as this can result in the denial of coverage and potential legal consequences.

- Do not accept a settlement offer without fully understanding the terms and implications. It’s important to review all details and consult with a professional if needed.