Kicking off with life insurance plans, this opening paragraph is designed to captivate and engage the readers with a breakdown of the different types and key factors to consider when selecting a plan. Exploring the benefits and how to determine the right coverage amount will guide you through the world of life insurance.

Types of Life Insurance Plans

Life insurance plans come in various types to cater to different needs and preferences. The three main types of life insurance plans are term life insurance, whole life insurance, and universal life insurance.

Term Life Insurance

Term life insurance provides coverage for a specific period, usually ranging from 10 to 30 years. It is typically more affordable than whole life insurance because it does not include a cash value component. Term life insurance is suitable for individuals looking for temporary coverage to protect their loved ones in case of an unexpected death.

Whole Life Insurance

Whole life insurance, as the name suggests, provides coverage for the entire lifetime of the insured individual. It includes a savings component known as cash value, which grows over time and can be accessed by the policyholder. Whole life insurance offers lifelong protection and can also serve as an investment vehicle due to its cash value feature.

Universal Life Insurance

Universal life insurance is a flexible type of permanent life insurance that combines the benefits of whole life insurance with the flexibility of adjustable premiums and death benefits. Policyholders have the option to adjust their premiums and death benefits based on their changing needs. Universal life insurance also allows for tax-deferred growth of cash value, making it a versatile option for long-term financial planning.

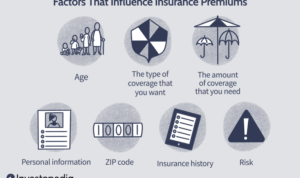

Factors to Consider When Choosing a Life Insurance Plan: Life Insurance Plans

When selecting a life insurance plan, there are several key factors to consider to ensure you choose the right coverage for your needs. It’s essential to assess your financial situation and long-term goals before making a decision. Factors such as coverage amount, premiums, riders, age, health status, and lifestyle all play a significant role in determining the most suitable life insurance plan for you.

Coverage Amount

Determining the right coverage amount is crucial when choosing a life insurance plan. You need to consider factors such as your current financial obligations, future expenses, and the financial needs of your dependents.

Premiums

Premiums are the amount you pay for your life insurance coverage. It’s important to choose a plan with premiums that you can afford in the long run. Consider your budget and financial stability when selecting a plan.

Riders, Life insurance plans

Riders are additional benefits that you can add to your life insurance policy for extra coverage. It’s essential to evaluate the riders offered by different plans and choose the ones that align with your specific needs and preferences.

Age, Health Status, and Lifestyle

Your age, health status, and lifestyle can impact the type of life insurance plan you should choose. Younger individuals generally pay lower premiums, while older individuals may face higher costs. Your health status and lifestyle choices, such as smoking or engaging in high-risk activities, can also affect your insurance options.

How to Determine the Right Coverage Amount

Determining the right coverage amount for a life insurance plan is crucial to ensure financial protection for your loved ones in the event of your passing. It involves calculating the appropriate amount based on various factors to adequately cover expenses and provide financial security.

Calculate Your Coverage Amount

- Start by assessing your current financial situation, including your income, debts, and expenses.

- Consider future financial obligations such as mortgage payments, education costs for children, and other expenses.

- Calculate the total amount needed to cover these expenses in case of your absence.

- Factor in inflation and potential changes in your family’s financial needs over time.

Factors Influencing Coverage Amount

- Your current income plays a significant role in determining the coverage amount needed to replace lost income.

- Outstanding debts, such as loans or mortgages, should be considered to ensure they are paid off in case of your passing.

- Future expenses like college tuition for children or healthcare costs should be factored into the coverage amount.

Income Replacement Concept

Income replacement is a crucial aspect of choosing the right coverage amount. It involves ensuring that the life insurance proceeds can replace the income you would have earned to support your family. By calculating the amount needed to sustain your family’s lifestyle and cover essential expenses, you can determine the appropriate coverage amount to provide financial security in your absence.

Benefits of Life Insurance Plans

Life insurance plans offer a variety of benefits for individuals and their families, providing financial security, peace of mind, and protection for loved ones in times of need. In addition, life insurance plans come with tax advantages and estate planning benefits that can further enhance their value.

Financial Security

Life insurance provides a financial safety net for your loved ones in the event of your passing. The death benefit can help cover expenses such as funeral costs, outstanding debts, mortgage payments, and daily living expenses, ensuring that your family is not burdened financially during a difficult time.

Peace of Mind

Having a life insurance plan gives you peace of mind knowing that your family will be taken care of financially if something were to happen to you. This assurance allows you to focus on living your life to the fullest without worrying about the financial well-being of your loved ones.

Tax Advantages

Life insurance plans offer tax advantages that can help you save money in the long run. The death benefit is generally received income tax-free by your beneficiaries, providing them with a financial cushion without the added tax burden. Additionally, the cash value component of certain life insurance policies can grow tax-deferred, allowing you to build wealth over time without paying taxes on the growth.

Estate Planning Benefits

Life insurance can play a crucial role in estate planning by providing liquidity to cover estate taxes and other expenses. It can help ensure that your assets are distributed according to your wishes and can prevent the need to sell off assets to cover tax liabilities. Life insurance can help preserve your legacy and provide for future generations by efficiently transferring wealth to your beneficiaries.