Looking for the best car insurance deals? Buckle up as we dive into the world of saving money while getting the right coverage. From tips to types, we’ve got you covered.

Overview of Car Insurance Deals

Car insurance deals are offers provided by insurance companies to car owners to protect their vehicles from financial losses in case of accidents, theft, or other damages. These deals typically involve different coverage options and premium rates based on the type of coverage chosen.

It is important for car owners to compare different car insurance deals to find the one that best suits their needs and budget. By comparing deals, car owners can ensure they are getting adequate coverage at a competitive price.

Getting the right insurance deal is crucial for car owners as it provides financial protection in the event of unforeseen circumstances. Without the right insurance coverage, car owners may face significant out-of-pocket expenses to repair or replace their vehicles.

Types of Car Insurance Deals

When it comes to car insurance deals, there are different types available to suit various needs and budgets. Each type offers different levels of coverage, so it’s essential to understand the differences to choose the right one for you.

Comprehensive Car Insurance

Comprehensive car insurance offers the highest level of coverage. It protects you against damage to your vehicle caused by accidents, theft, natural disasters, and more. This type of deal is suitable for new or expensive cars, providing peace of mind for drivers.

Third-Party Car Insurance

Third-party car insurance is the most basic and mandatory type of coverage. It protects you against claims from third parties for damages or injuries caused by your vehicle. This deal is suitable for older cars or budget-conscious drivers looking for the minimum legal requirement.

Collision Car Insurance

Collision car insurance covers damages to your vehicle resulting from a collision with another vehicle or object. This type of deal is suitable for drivers who want coverage for accidents but may not need the comprehensive protection offered by comprehensive insurance.

Uninsured/Underinsured Motorist Coverage

This type of coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or enough insurance to cover your damages. It can also help with hit-and-run incidents. This deal is suitable for drivers concerned about being financially protected in such situations.

Rideshare Insurance, Car insurance deals

For those who drive for ridesharing services like Uber or Lyft, rideshare insurance provides coverage for both personal and commercial use of your vehicle. It fills the gap left by personal auto insurance policies that may not cover accidents that occur while driving for a rideshare service. This type of deal is essential for rideshare drivers to ensure they are fully protected while on the job.

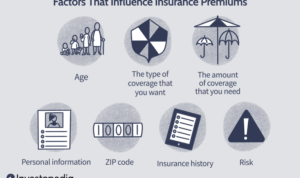

Factors Influencing Car Insurance Deals

When it comes to car insurance deals, there are several key factors that can influence the cost of your premiums. Understanding these factors can help you make informed decisions when choosing the right insurance coverage for your vehicle.

Age, driving history, type of vehicle, and location all play a significant role in determining the cost of car insurance deals. Let’s take a closer look at how each of these factors can impact your insurance premiums.

Age

Age is a crucial factor that insurance companies consider when calculating your premiums. Younger drivers, especially teenagers, are often charged higher rates due to their lack of driving experience and higher likelihood of being involved in accidents. On the other hand, older drivers may also face higher premiums as they are considered to have a higher risk of accidents due to factors like slower reaction times.

Driving History

Your driving history is another important factor that can affect your car insurance deals. If you have a history of accidents, traffic violations, or DUIs, insurance companies may see you as a high-risk driver and charge you higher premiums. On the other hand, a clean driving record can lead to lower insurance rates as it demonstrates that you are a responsible driver.

Type of Vehicle

The type of vehicle you drive also plays a role in determining your insurance premiums. Sports cars and luxury vehicles are typically more expensive to insure due to their higher value and increased risk of theft or damage. On the other hand, economical and safe vehicles may qualify for lower insurance rates.

Location

Your location can also impact the availability of different car insurance deals. Urban areas with higher rates of accidents and theft may result in higher premiums compared to rural areas with lower risk factors. Additionally, states with different insurance regulations and requirements can also influence the cost of your insurance coverage.

Tips for Finding the Best Car Insurance Deals

When it comes to finding the best car insurance deals, there are a few key strategies to keep in mind. From comparing different insurance options to negotiating with providers, these tips can help you secure the right coverage at the right price.

Comparing Different Insurance Deals

- Start by gathering quotes from multiple insurance companies to compare rates and coverage options.

- Consider factors such as deductibles, coverage limits, and additional benefits offered by each policy.

- Use online comparison tools or work with an independent insurance agent to streamline the process.

Reading the Fine Print

- Always read the fine print of insurance policies to understand exclusions, limitations, and any hidden fees.

- Pay attention to details such as coverage for rental cars, roadside assistance, and claims processes.

- Ask questions and seek clarification on any aspects of the policy that are unclear to avoid surprises later on.

Negotiating Better Deals

- Don’t be afraid to negotiate with insurance providers for better rates or discounts based on your driving history or loyalty as a customer.

- Consider bundling multiple insurance policies with the same provider to qualify for a multi-policy discount.

- Review your coverage periodically and make adjustments based on changes in your driving habits or vehicle value to ensure you’re getting the best deal.